Two teachers encourage students to become financially literate

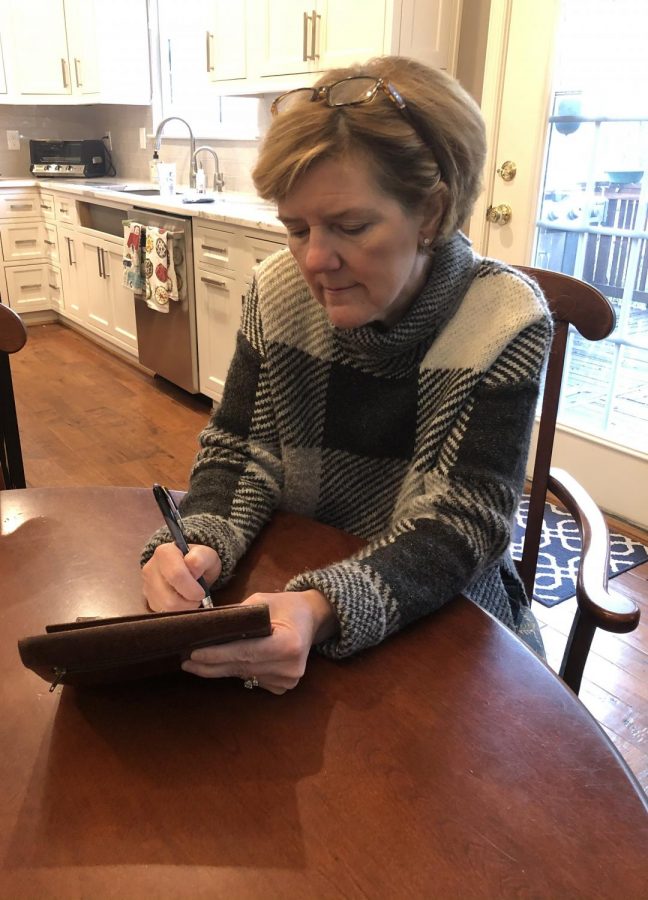

Photo Credit Ms. Barbara Marshall

Ms. Marshall, a qualified teacher for Personal Finance and Economics, “You need to understand how to create a budget to plan your spending for your needs and wants, needs being your rent, food, utilities, things like that.”

Americans owe a collective $1.54 trillion in student debt in 2020. In a Forbes survey, it was exposed that 73% of adults in the U.S. admitted to living paycheck to paycheck last year. How did this happen? Millions of students get their first paychecks and spend them needlessly.

Two teachers at Rachel Carson have worked to give students what they need in the finance field.

“You need to start planning for the future,” said Ms. Barbara Marshall, the Coding and Innovative Technologies teacher.

Managing finances is a huge problem in the United States. Millions of college students are not financially literate enough when they graduate, according to a 2017 survey by Champlain College.

“Financial education is a really important topic for students to learn,” said eighth-grader Roshan Ram, “and they can also avoid lots of investment problems like debt and bankruptcy if they were going to start a business.”

Many students do not know about financial concepts when they graduate college, and they do not have enough money later on in life. According to polls from Yahoo Finance, about 64% of adults said they were not confident about retiring with enough money.

Students need to be taught about investing and saving.

“The earlier you start investing and saving your money, you could have accumulated a lot of money because that money would have made money for you,” said Ms. Marshall, who has taught her two kids about finance and tells them to put some money aside for later.

Students can also be taught financial education at home. Ms. Marshall and Ms. Jennifer Wright both had parents that taught them and made them financially literate. Ms. Marshall went a step further and decided to take financial courses in college. She has a major in Marketing and Management/Business Administration. A Yahoo Finance survey unveiled that only 22% of parents teach their kids about finances, which includes saving, budgeting and investing, and credit/taxes. This shows financial education is not taught that much at home. Another study shows most parents think financial education should be taught in a formal environment, like school, instead of at home.

Another investment vehicle is the stock market. Thousands of companies list their stocks, and these stocks are bought and sold on stock exchanges. It is a quick and risky way to invest money.

Ms. Marshall said, “My first employer suggested that I put money in the stock market.” Years from then, she is now making modest returns on her investments in the stock market.

Ms. Marshall also believes that more youngsters have resources, like time.

“When you are young, you have more time to put money into the stock market and possibly rebound from fluctuations in it,” she said.

She is also qualified to teach the course Personal Finance and Economics. She says that risk management is the key to being successful in the stock market.

“A diverse portfolio is recommended,” she said, “and with it, you will be better prepared to manage risk.”

Spending lots of money after graduating from college needlessly is theoretically not a logical idea. According to a census by Gold Man Sachs, millions of students spend their money on cars, homes, parties, and more.

“Students spend their first paychecks on items their parents would not buy for them,” she said.

Ms. Wright agrees: “Students buy things their parents did not get.”

Many students do not know about topics like credit and loans, so they take huge loans, which can be easily avoided. Many students might get into trouble with banks due to them not paying their student loans and other loans for other items.

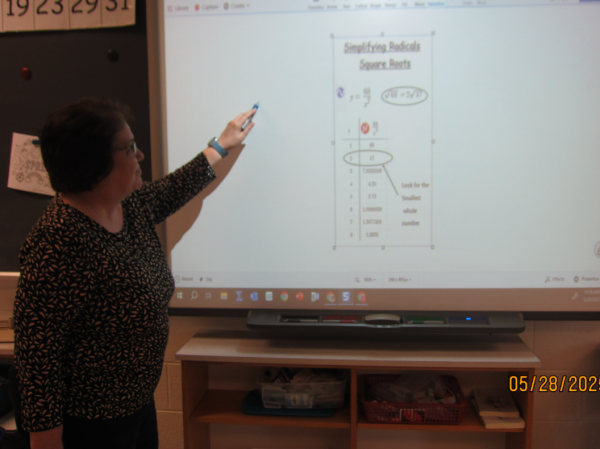

Ms. Wright, a qualified teacher for the course Personal Finance and Economics, said, “Students need to understand everything before they graduate high school.”

Ms. Wright thinks the most important topics to learn before graduating are credit, interest, taxes, insurance, and loans. She also thinks finances should be taught very early in life, so students know what it is by the time they start college.

Ms. Marshall thinks the same topics are important but would add a few concepts, like budgeting.

“The course should at least teach you how to budget your money,” she said.

Many people have many bills they have to pay, and a budget would be very helpful.

“You need to understand how to create a budget to plan your spending for your needs and wants, needs being your rent, food, utilities, things like that,” said Ms. Marshall.

Now, all FCPS students have to take at least one semester of Personal Finance and Economics. There are highly qualified teachers, and they teach all the important topics students should learn before graduating. Roshan Ram says he would take the course. Another student at Rachel Carson named Arhan Puvvada agrees although Arhan would take the course in middle school.

He said, “I would take the course if they gave it.”

Arnav Gupta is an eighth-grader at Rachel Carson MS. He enjoys playing sports, chess and photography. At school, he likes Tech Ed and CIT.