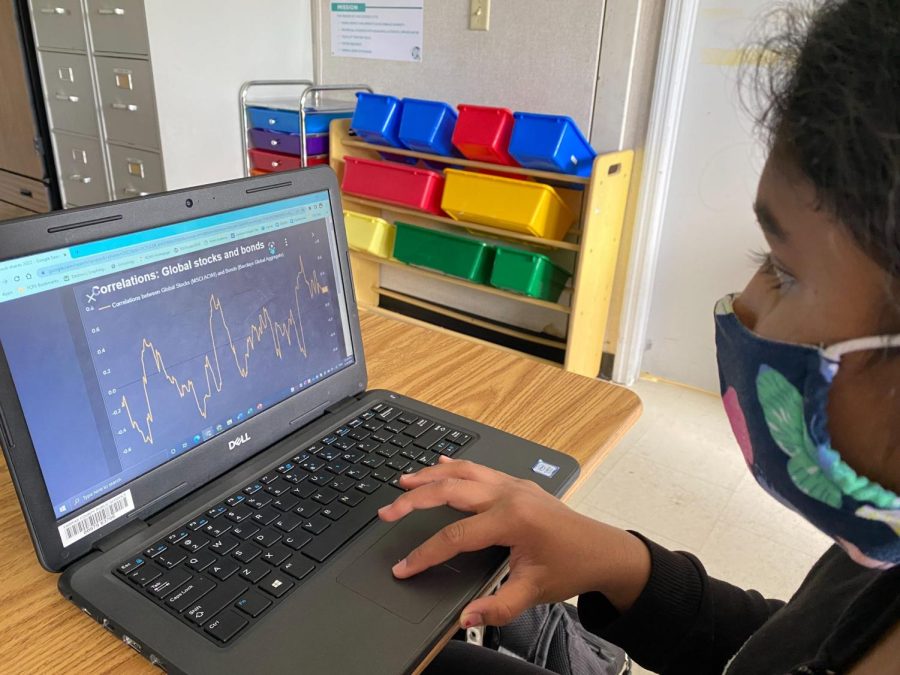

Numerous students investing in the stock market

Keen to make and save money, high school and college students partake in investing in the stock market, and even some RCMS students have already invested at such an early age.

According to CNBC, 39% of teens in the U.S. see the stock market as an opportunity to make money quickly, while 20% believe it’s too risky. However, 40% still think stocks are a good long-term investment. Only half of teens believe the stock market is a good thing for everyday Americans.

Investors under age 18 are not allowed to own stocks, mutual funds, and other financial assets outright. Teens can make investments only under the supervision of parents and guardians through a custodial account.

Some people think that investing early benefits their futures, like John Rieckewald, an eighth-grader from the Xtreme team.

John thinks that the benefits of investing early is having money and experience in the stock market, which people can use in the future, since people put large amounts of money in the stock market. It gives some people a head start, especially at the teen age to invest early in a time like this. Accumulating large amounts of money in decent time assists them when they have the need to pay for large monetary costs including college and housing.

John Rieckewald has a friend, who in tandem with his friend’s father, has made thousands upon thousands of dollars investing in stocks. He also talked about how the present is the best time to invest.

“There is a major silicon shortage right now, which is causing major supply issues with graphics cards and computer processors, and higher demand than ever for them,” said John. “Because of this, people will pretty much buy anything that is sold by a big tech company like Intel or Advanced Micro Devices, basically guaranteeing the success of those companies with certain products. This can substantially increase stock prices, in turn giving you great returns on your investment.”

Even some professional investors agree with investing early.

“It takes far less to save and invest when you’re young instead of waiting until you’re older and needing to catch up,” said Winnie Sun, a financial advisor and founding partner of Sun Group Wealth Partners, when being interviewed for CNBC.

On the other hand, some people think that there is a risk in investing at such a young age, including Lexi Shalim, a seventh-grader from the Dream team.

“I feel like there is a risk in losing money,” said Lexi, “or just wasting money in general. Students have plenty of opportunities to make their money in the future.”

Some agree on investing but also agree to be careful with the money, like Mrs. Barbara Marshall, the CIT teacher of RCMS.

“You should definitely invest in stocks at any age if you have money to lose,” said Mrs. Marshall. “It’s a gamble, there is always a risk.”

Compound Interest

Compound interest or compound growth could help make your money grow faster, since compounding can create a snowball effect, as the original investments plus the income earned from those investments grow together.

According to Ramsey Solutions, investing early could get people more money.

Here is a fictional example to prove its point. At the age of 21, Jack started to invest $200 a month every year for nine years, but then he stopped investing at the age of 30. On the other hand, his friend Blake started investing just as Jack stopped, and Blake started investing $200 a month up to the age of 68.

At the age of 68, Jack invested $216,00, and had the profit of approximately $2.35 million; while Blake invested $91,200 but had the profit of $1.3 million.

Tips to Make Money in Stocks

1. Avoid short-term investments: Buy and hold

You should hold stocks or other deposits for a long time instead of engaging in constantly buying and selling. This is important because most investors who frequently make deals in stocks tend to miss opportunities for strong annual returns.

For example: According to Putnam Investments, from 2012 to 2017, the market returned 9.9% of the investments annually to the investors that had remained fully invested. The annual return for missing out on the 20 best days was only 2%.

2. Opt for diversified funds over individual stocks

Stocks are individual shares that could represent an investor’s contribution to a corporation when investing money. Individual stock can give you more control with lower overall costs, but that is when you have the time to get involved. This method is not always perfect, however. When investing, you need to understand the risk of your investments and the general principles of diversification.

Diversified funds is an investment fund that investors put in a big pool with other investors’ money, this could ultimately reduce the money’s risk. Diversified funds have to go through a process called diversification. Diversification is the key to reduce boost and might boost returns over time. This time-tested investing practice is also called creating a diversified portfolio. In this practice, your and other investors’ money is taken to a single pool and spread across an extensive selection of investments. This is just like not putting all of your eggs in one basket, which helps spread your overall risk.

Anything has a risk, and investment funds also do. This is because the value of investments can rise but also fall, thus you could potentially get less than you invest. Experts recommend people to invest in funds like the S&P 500 or Nasdaq, where investors can track the major indexes. This way, you can get the average 10% annual return as simply and cheaply as possible.

3. Reinvest your dividends

A dividend is a periodic payment based on the stocks’ earnings. In the period from September 1921 through September 2021, S&P 500 tracked average annual returns to be 6.7%. And when dividends were reinvested, the annual returns rose up to approximately 11%. If you reinvest your dividends, you will get more shares, hence it increases your compound interest more rapidly. At first, the dividends that you get back might be very small, but it would increase over time if you buy and hold. In most brokerage companies, you could automatically reinvest your dividends by just signing up for the DRIP, abbreviated for dividend reinvestment program.

4. Buy the right investment and be prepared for a downturn

This part is definitely easier said than done, and it requires investors to think thoroughly before making any decisions. First, take a look at your entire financial situation, like your bank account money and your budget. Then, think about what you really want from investing. Look at the stock share datas and be informed of what the greatest investors have to say and their actions. You don’t have to do the exact same thing as the greatest investors, but just think about why they make the decision and what factors are there in the investment.

Keep in mind that there will always be risks, no matter what the current stock situation is, so being prepared is essential. If you are not a risk taker, think about the consequences first before making any decisions. In addition, if you’re looking for a guaranteed return, perhaps a high-yield CD might be better. And if you are a risk taker, just be decisive and go for it.

5. Try a stock market simulator before investing real money

One way to enter the world of investing without taking risk is to use a stock simulator. You can get the app in the app store. It is an online trading account with virtual money, so it won’t put your real money at risk. You could also think about the way you should react if the virtual money was your real money.

“That can be really helpful because it can help people overcome the belief that they’re smarter than the market,” said Dan Keady, chief financial planning strategist at TIAA, when being interviewed for Bankrate. “They can always pick the best stocks, always buy and sell in the market at the right time.”

6. Overall

You never have to spend days just to see which individual companies’ stocks would go up or go down in just a short term. If you want to make money, you need to look far. One of the most successful investors, Warren Buffett, recommended people to invest in low-cost index funds, then hold onto the funds for a long period of time. Just keep in mind to always look at the big picture and look far. Be calm no matter what happens. It definitely takes time, so investing early is crucial to making money.

“Don’t panic when the market does,” said Elon Musk, currently the richest man in the world, on Mint.